KRA officials visit Eastleigh to educate businesses on new tax provisions

By Abdirahman Khalif |

The KRA's efforts in Eastleigh are part of a broader initiative to enhance tax compliance and broaden the tax base, ensuring that more businesses contribute to national revenue.

Kenya Revenue Authority (KRA) officials visited Eastleigh on Thursday to sensitise business people about new tax provisions. This visit focused on turnover tax, value-added tax (VAT), rental income, and compliance with the new electronic Tax Invoice Management System (eTIMS).

In recent months, KRA revenue assistant personnel have been visiting Eastleigh to educate and recruit new members as part of the government's effort to expand the tax base.

Keep reading

- KRA demands taxpayers' phone numbers, physical addresses in cleanup

- Senate Public Accounts Committee faults treasury over tax on foreign donor funds

- NGOs report reveals increased funding as only 2,829 organisations file returns

- Eastleigh Business District Association donates food to Kamukunji families

Thursday's visit was a follow-up to previous visits aimed at reinforcing these efforts.

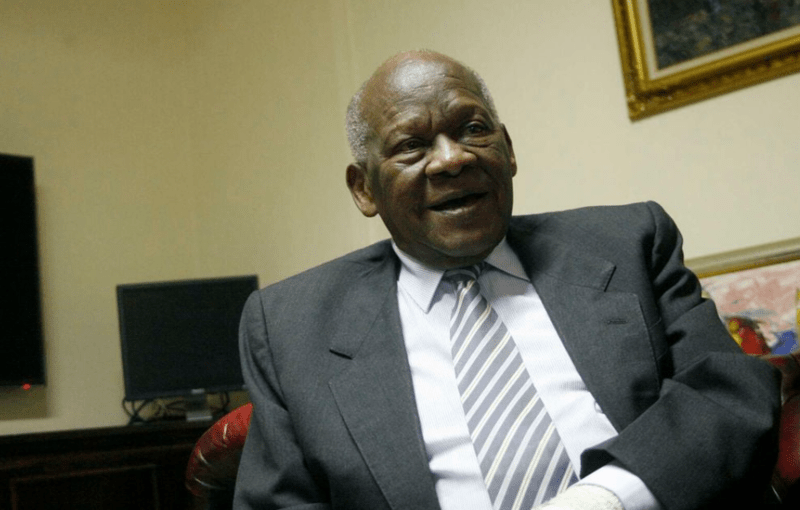

Johan Cheptogoch, Chief Manager of Compliance for East and South Nairobi, stated that the purpose of the visit was to educate business people on tax payment methods and the consequences of non-compliance.

Cheptogoch highlighted the importance of understanding the challenges faced by tax assistant personnel in Eastleigh and finding ways to address them.

"We came here to see the challenges faced by our people and what we can do about it going forward," said Cheptogoch.

He was accompanied by eTIMS experts, compliance officers, and interpreters to ensure clear communication with the business community.

Mohamed Adan, Chief Executive Officer of the Eastleigh Business District Association, stated that the business community had been well informed about the KRA requirements.

He emphasised the importance of compliance and noted that Eastleigh is a significant contributor to government revenue.

Johan Cheptogoch, Chief Manager of Compliance for East and South Nairobi led the KRA team that was carrying out the tax sensitisation in Eastleigh. (Photo: Abdirahman Khalif)

Johan Cheptogoch, Chief Manager of Compliance for East and South Nairobi led the KRA team that was carrying out the tax sensitisation in Eastleigh. (Photo: Abdirahman Khalif)

Nairobi County government receives over 30 per cent of its annual revenue from Eastleigh as stated by Governor Johnson Sakaja when he visited the area in April.

"Eastleigh is one of the places the government receives revenue in terms of tax," said Mohamed.

He added that all businesses in Eastleigh are ready to adopt the new eTIMS system and comply with KRA regulations.

In 2023, KRA introduced eTIMS, a web-based software solution designed to ensure overall tax compliance.

Unlike the earlier TIMS, which required taxpayers to purchase new machines, eTIMS can be installed on computers and mobile phones or accessed online, offering greater convenience and flexibility.

Prior to 2024, only VAT-registered taxpayers were required to comply with TIMS. However, the recent amendment extends this requirement to both VAT-registered and unregistered taxpayers, necessitating compliance with eTIMS.

Taxpayers already compliant with TIMS are not required to register for eTIMS but must ensure all their sales are TIMS/eTIMS compliant. This recent communication specifically targets taxpayers who are not yet compliant with TIMS/eTIMS.

The KRA's efforts in Eastleigh are part of a broader initiative to enhance tax compliance and broaden the tax base, ensuring that more businesses contribute to national revenue.